Overview

The ICES Accounting System is a software solution designed to help you monitor accounting processes more efficiently and provides financial record of the business.

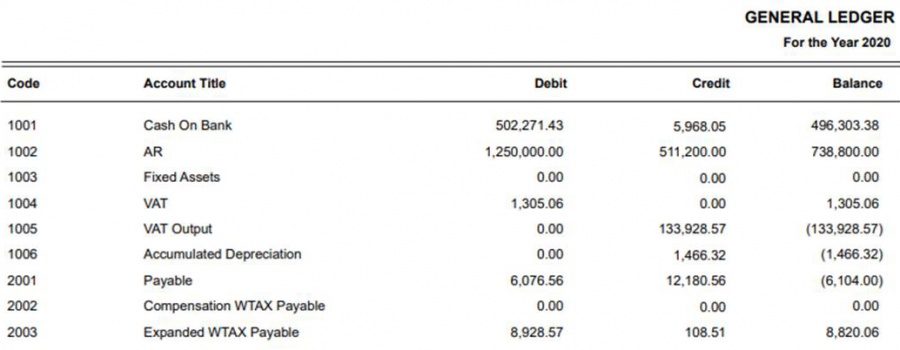

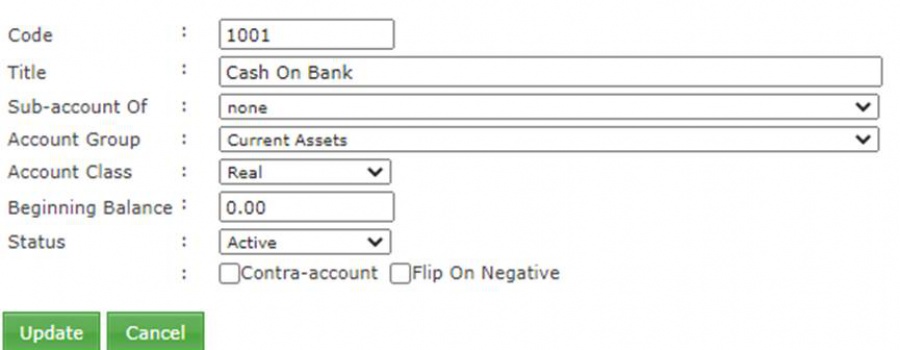

Set up the chart of accounts easily to record and maintain list of your company’s accounts for recording transactions. Receive and apply payments to invoice and receivable transactions using the cash receipt module. And, generate a complete record of your company’s financial transactions using the general ledger. It can also be viewed in summary or detailed format and can be filtered in Yearly, Quarterly or Monthly scheme.

Key Features

Accounts Receivable – Facilitates the preparation of invoices and monitoring of clients’ owed money to your company and receive payments in full or partial amounts by retrieving billing information from different preference options in cash receipt

Accounts Payable – Manages and tracks every bill payment you make and owe to suppliers easily and generate aging report whenever you need it to ensure that no bill or past dues are forgotten

General Journal – Enables you to enter general transactions, corrections and adjustments

Manage Checks – Simplifies recording and monitoring of check payments. With this, you can minimize the time it takes to receive payments in check form in cash receipt

Bank Reconciliation – Identifies any discrepancies in book balance against bank statement and facilitates in reconciling both balances at particular period

Fixed Asset Management – Maintains and manages your fixed assets from recording to disposal. Supports various depreciation methods to adapt to your company’s needs. It also allows you to post depreciation expense on a monthly or yearly scheme and automatically generates journal entry for posting

Locking/Posting Transaction – Ensures that transactions from previous months can no longer be altered by other users. The posting feature automatically computes and posts the ending balance of all accounts and set it as the beginning balance for the following year

Audit Trail – Captures all account activities and tags it to the originating user and transaction details

Secure Access – Implements role-based authentication. Level of access to transaction is restricted based on role given to the user

General Ledger – Generate a complete record of financial transactions of your company which holds the account information to prepare financial statements in summary or detailed formats

Financial Statements – Generates financial reports such as balance sheet, income statement and cash flow report to show and analyze company’s financial condition

BIR Reports – Generates an alphalist of withholding taxes in different forms in yearly, quarterly and monthly schemes

Easy to Learn – User-friendly, intuitive and can be learned by anybody even those who are not tech savvy