Overview

The ICES Lending System is a software solution designed to help you effectively manage your lending business in processing loans and generating ledger for monitoring clients balances.

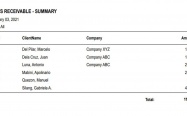

A loan calculator is available to help you determine the monthly payments of a loan based on amount, loan term and number of payments. You can view and update client information and keep track of loan payments and remaining balances. And, you can generate summary of clients’ receivables based on balance or due date as of particular date.

Key Features

Loan Products Management – Enables you to create several loan products and set up inclusions such as deductions, interest, penalty and other applicable fees for each product

Efficient Processing – Improves productivity of employees with fast processing of loan from application to releasing of proceeds

Loan Reconstruction – Supports recalculation of loan amortization should there be a need to adjust the payment period even after loan approval. Simply enter the new loan term to generate the adjusted loan ledger

Client Profile– Maintains and manages client information and facilitates in monitoring current loans balances and payments as well history of past loans

Calculator – A tool that provides a quick way to calculate how much your monthly payment will be on your selected loan without hassle

Flexible Payment Collection – Payment can be in the form of cash, check, PDC or auto-debit type

Cash In/Disbursement – Enables you to record and view cash in and payment transactions easily

Easy to Learn – Clean, simple user interface that does not require much of learning curve

Secure Access – Level of access to information is restricted based on role given to the user